Overview

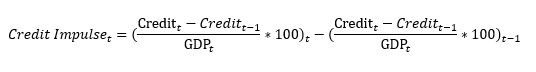

The Credit Impulse — a term coined by former Deutsche Bank economist Michael Biggs — measures the change in the flow of new credit relative to the size of an economy. It serves as a leading indicator of future economic activity, reflecting whether credit conditions are becoming more supportive or restrictive.

Methodology

In our analysis, we follow the most common methodology using data from the BIS and IMF to:

- Measure the annualized quarterly change in credit provided to the private sector and express this change as a share of GDP

- Calculate the second derivative of the credit flow expressed as a percentage of GDP. Since the series is already expressed in percentage terms, we apply a simple quarter-on-quarter change to approximate the second derivative.

- Aggregate individual country credit impulses into a global index by weighting ach series according to its corresponding GDP.

- Provide two variants of the credit impulse: an unadjusted version and a version smoothed over a 5-year period.

Therefore, the formula for Macrobond’s Credit Impulse is:

where:

Credit = credit to non-financial sectors (from banks to private sector), annualized. Sourced by BIS.

GDP = nominal GDP, annualized. Sourced by IMF.

Examples

Slightly redesigned chart to ensure greater methodological consistency and to broaden the scope by including more countries, providing a clearer view of the global credit environment.

Redesigned chart for Euro Area.

Redesigned chart for Germany.

We have used mix of series from BIS and national sources and weighted them with GDP series from IMF.